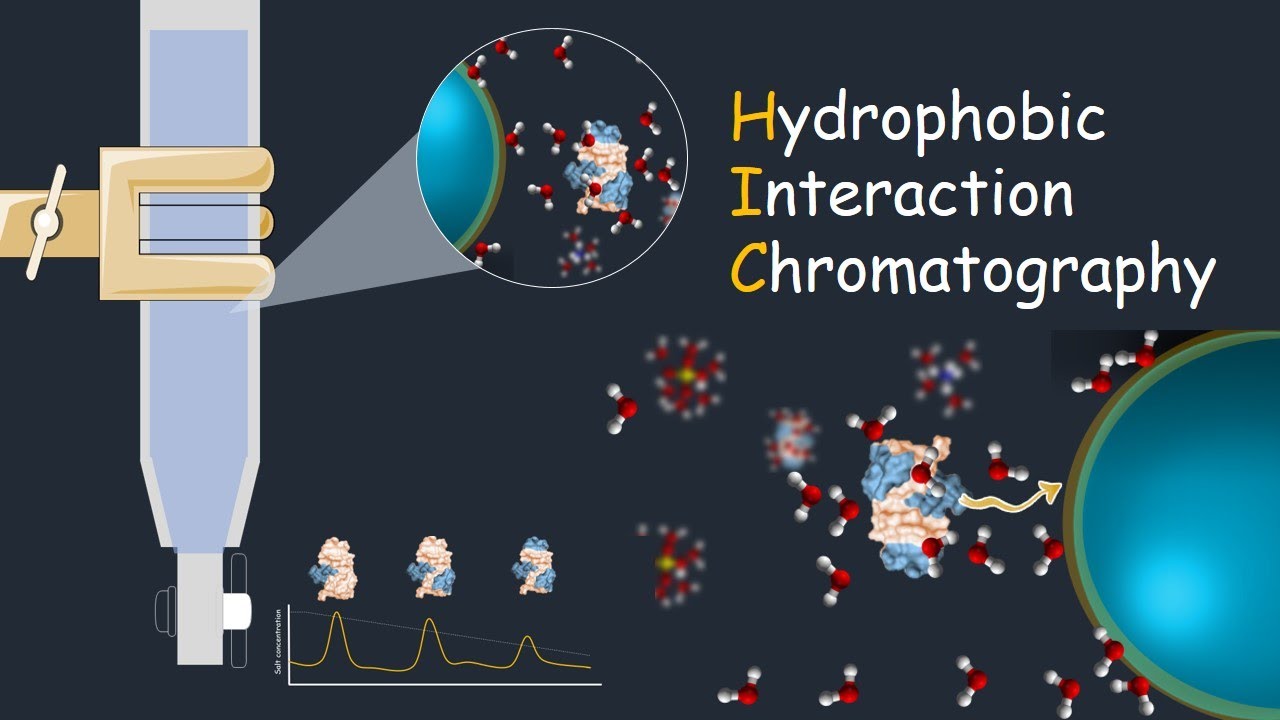

A. Overview of Hydrophobic Interaction Chromatography (HIC)

Hydrophobic Interaction Chromatography (HIC) is a versatile and essential separation technique used in the biopharmaceutical industry and other fields of bioseparation. It relies on the principle of hydrophobic interactions, where non-polar molecules tend to aggregate in the presence of high-salt buffers or organic solvents. In HIC, these hydrophobic interactions are harnessed to separate and purify a wide range of biomolecules, including proteins, nucleic acids, and viruses. HIC is characterized by its ability to maintain the biological activity of the target molecules during the separation process, making it a preferred choice in the downstream processing of biopharmaceuticals.

B. Importance of HIC in Biopharmaceutical Industry

The biopharmaceutical industry is at the forefront of the demand for HIC due to the growing importance of biologics, such as monoclonal antibodies, vaccines, and gene therapy products. These complex biomolecules require precise purification techniques to meet stringent regulatory requirements and ensure patient safety. HIC offers a unique advantage in the purification process by allowing selective separation based on hydrophobicity while preserving the biological activity of the target molecules. This is particularly crucial for monoclonal antibodies, which have gained prominence in the treatment of various diseases, including cancer and autoimmune disorders.

C. Market Growth Drivers

The global HIC market is experiencing robust growth, driven by several key factors:

- Increasing Demand for Monoclonal Antibodies: Monoclonal antibodies have emerged as a cornerstone of precision medicine and immunotherapy. The rising incidence of chronic diseases and the need for personalized therapies fuel the demand for monoclonal antibodies, directly benefiting the HIC market.

- Advancements in Biopharmaceutical Research: Ongoing research and development efforts in the biopharmaceutical sector continue to expand the portfolio of biologics. This expansion necessitates efficient and scalable purification techniques like HIC.

- Growing Investment in Healthcare R&D: Governments, pharmaceutical companies, and research institutions are channeling substantial investments into healthcare research and development. These investments stimulate innovation and drive the adoption of advanced purification methods, including HIC.

- Expanding Biotechnology Industry: The biotechnology industry, marked by innovation in bioprocessing and the development of novel biologics, presents a substantial market for HIC products and services.

- Regulatory Support and Guidelines: Stringent regulatory requirements for drug approval necessitate rigorous purification processes. HIC, with its ability to maintain product integrity, aligns with these regulatory standards, making it an attractive choice for biopharmaceutical manufacturers.

II. Market Size and Trends

A. Global Market Size in 2023

As of 2023, the global HIC market had reached a significant milestone, with a total market size valued at USD 342.5 million. This remarkable valuation underscores the market’s presence and importance within the broader biopharmaceutical and bioseparation landscape.

B. Factors Contributing to Market Growth

Several factors are contributing to the sustained growth of the HIC market:

- Diversification of Therapeutic Modalities: Beyond monoclonal antibodies, the biopharmaceutical industry is exploring diverse therapeutic modalities, including cell and gene therapies. These therapies require efficient purification, further boosting the demand for HIC.

- Customized HIC Solutions: Companies are increasingly offering customized HIC solutions tailored to specific bioprocessing needs, enhancing the versatility and adoption of HIC technology.

- Automation and Process Optimization: Automation and process optimization are becoming key trends, leading to increased efficiency and scalability in HIC-based purification processes.

C. Forecasted CAGR for 2024-2032

The market’s potential is exemplified by its projected Compound Annual Growth Rate (CAGR) of 6.9% for the period from 2024 to 2032. This sustained growth trajectory reflects the market’s adaptability and resilience in the face of evolving industry dynamics.

D. Projected Market Value by 2032

By the end of 2032, the HIC market is expected to achieve a market value of USD 626.6 million. This projection reaffirms the market’s long-term potential and its vital role in biopharmaceutical purification processes.

III. Market Segmentation

A. By Product Type

- Resins

- HIC resins serve as the heart of chromatography columns. They are carefully designed to provide specific binding capacities and selectivity for target molecules. Resins are a cornerstone of the HIC market, and their quality directly impacts separation efficiency.

- Columns

- HIC columns are specialized chromatography columns that house the chromatography resins. They come in various sizes and formats, catering to different scales of bioprocessing, from laboratory-scale research to large-scale biomanufacturing.

- Reagents

- Reagents used in HIC include buffer solutions, salts, and elution agents. These reagents are essential for optimizing binding and elution conditions during the chromatography process, ensuring efficient separation.

B. By Application

- Monoclonal Antibodies

- Monoclonal antibodies (mAbs) represent a dominant application of HIC. The versatility of HIC allows for the purification of mAbs with high yield and purity, meeting the stringent requirements of therapeutic production.

- Vaccines

- HIC is instrumental in the purification of vaccine components, ensuring their safety and efficacy. Vaccine manufacturers rely on HIC to meet regulatory standards.

- Recombinant Proteins

- Recombinant proteins, including enzymes and therapeutic proteins, benefit from HIC purification for various pharmaceutical applications. HIC offers a reliable method for obtaining pure and biologically active proteins.

- Gene Therapy Products

- The gene therapy segment utilizes HIC for purifying viral vectors, plasmids, and other critical components. Purification is vital for ensuring the safety and effectiveness of gene therapy products.

C. By End-user

- Biopharmaceutical Companies

- Biopharmaceutical companies are the primary users of HIC technology. They rely on HIC for the purification of their products, ranging from monoclonal antibodies to complex gene therapies. The growth of this segment closely mirrors the expansion of the biopharma industry.

- Contract Research Organizations

- Contract Research Organizations (CROs) provide research and development services to biopharmaceutical companies. They play a crucial role in the outsourcing of HIC-related processes, ensuring cost-effective and scalable solutions.

- Academic and Research Institutes

- Academic and research institutes utilize HIC in various research projects, advancing the understanding of biomolecular interactions and supporting the development of novel biopharmaceuticals.

IV. Factors Driving Market Growth

A. Increased Demand for Monoclonal Antibodies

The surging demand for monoclonal antibodies (mAbs) is a pivotal driver of market growth. Monoclonal antibodies have revolutionized the treatment landscape for various diseases, including cancer, autoimmune disorders, and infectious diseases. This increasing demand for mAbs as therapeutic agents fuels the adoption of HIC for their purification.

B. Advancements in Biopharmaceutical Research

Biopharmaceutical research continues to advance at a rapid pace, driven by breakthroughs in genomics, proteomics, and bioprocessing technologies. This innovation results in a growing portfolio of biologics with diverse structures and functions. HIC’s flexibility and capability to handle a broad range of biomolecules make it indispensable for purifying these complex entities, ensuring their safety and efficacy.

C. Growing Investment in Healthcare R&D

Governments, pharmaceutical companies, and research institutions are making substantial investments in healthcare research and development. These investments are directed toward understanding diseases at the molecular level and developing targeted therapies. As biopharmaceuticals become increasingly central to these efforts, the demand for advanced purification techniques like HIC escalates.

D. Expanding Biotechnology Industry

The biotechnology industry is experiencing a period of unprecedented growth and innovation. Advancements in bioprocessing, cell culture technologies, and biomanufacturing processes have propelled the development of novel biologics. HIC, with its ability to meet the rigorous purification demands of these new biologics, is an essential component of the biotech landscape.

E. Regulatory Support and Guidelines

Regulatory agencies worldwide emphasize the need for rigorous purification and characterization of biopharmaceutical products. Strict regulatory standards and guidelines ensure product safety and efficacy. HIC, with its ability to maintain the structural and functional integrity of biomolecules, aligns with these regulatory requirements, instilling confidence in its use.

V. Challenges and Constraints

A. High Cost of HIC Products

One notable challenge in the adoption of HIC is the cost associated with HIC resins, columns, and equipment. High-quality resins and columns can be expensive, making them a barrier for smaller biopharmaceutical companies, academic institutions, and research laboratories with limited budgets. Addressing cost-related challenges through innovation and cost-effective solutions is crucial to widen HIC’s adoption.

B. Technological Barriers

HIC technology requires specialized knowledge, training, and equipment. Smaller laboratories and organizations may face difficulties in adopting and implementing HIC due to the need for skilled personnel and technical resources. Providing access to training and technology transfer could help mitigate these barriers.

C. Competition from Alternative Chromatography Techniques

While HIC is highly effective for specific applications, it faces competition from alternative chromatography techniques, including size exclusion chromatography, ion exchange chromatography, and affinity chromatography. The choice of chromatography technique often depends on the characteristics of the target molecule and the purification objectives. Ensuring that HIC remains a competitive option requires ongoing innovation and adaptation.

VI. Regional Analysis

A. North America

- North America, particularly the United States, holds a substantial share of the HIC market. The region benefits from a robust biopharmaceutical industry, a strong research infrastructure, and a history of innovation in bioprocessing technologies. These factors collectively drive the adoption of HIC in both research and large-scale production.

B. Europe

- Europe, with key players in countries like Germany, Switzerland, and the United Kingdom, contributes significantly to the HIC market. The European biopharmaceutical industry thrives on collaborations between academia, research institutions, and pharmaceutical companies, fostering the demand for advanced purification technologies such as HIC.

C. Asia-Pacific

- The Asia-Pacific region, including countries like China and India, is witnessing substantial growth in the biopharmaceutical sector. The region’s burgeoning population, increasing healthcare expenditures, and a growing focus on domestic biomanufacturing have led to a surge in demand for HIC products and services.

D. Latin America

- Latin America is experiencing a gradual but steady adoption of HIC technology. The region’s pharmaceutical and biotechnology sectors are expanding, driven by factors such as population growth and increasing healthcare access.

E. Middle East and Africa

- The Middle East and Africa exhibit potential for growth in the HIC market. Expanding healthcare infrastructure, investment in research, and collaborations with global pharmaceutical companies contribute to the region’s growing interest in advanced bioprocessing techniques like HIC.

VII. Competitive Landscape

A. Key Players in the HIC Market

- Several key players dominate the HIC market, offering a range of products and services. These companies include well-established manufacturers of chromatography products such as GE Healthcare, Merck KGaA, Bio-Rad Laboratories, and others. Their market presence and reputation are built on decades of experience and innovation in bioseparation technologies.

B. Market Share Analysis

- Market share analysis provides valuable insights into the competitive positioning of key players within the HIC market. Understanding market dynamics and the strategies of leading companies helps stakeholders make informed decisions and anticipate market trends.

C. Strategic Alliances and Collaborations

- Many companies in the HIC market engage in strategic alliances, collaborations, and partnerships to expand their product portfolios and enhance their market presence. These collaborations often lead to the development of innovative HIC solutions, improved customer support, and broader global reach.

VIII. Future Market Outlook

A. Emerging Trends and Opportunities

- The HIC market is poised to witness several emerging trends and opportunities:

- Continuous Innovation in HIC Technology: Ongoing research and development efforts focus on improving HIC resins, columns, and instrumentation. Expectations for enhanced selectivity, binding capacity, and ease of use are driving innovation in HIC technology.

- Development of High-Performance Resins: Companies are actively working on the development of high-performance HIC resins with improved properties, enabling more efficient biomolecule purification.

- Integration of Automation: Automation and robotics are becoming integral to bioprocessing. The incorporation of automation into HIC workflows streamlines processes, reduces human error, and enhances reproducibility.

B. Market Entry Strategies

- New entrants and existing players in the HIC market may employ various strategies to enter or expand within the market:

- Mergers and Acquisitions: Companies may consider mergers and acquisitions to broaden their product offerings or acquire innovative technologies.

- Strategic Partnerships: Collaborations with research institutions or biopharmaceutical companies can facilitate technology transfer and product development.

- Product Diversification: Expanding product portfolios to address specific niche markets or emerging purification needs can be a strategic move.

C. Potential Market Disruptors

- While the HIC market shows strong growth potential, it may also face disruptive factors:

- Novel Chromatography Techniques: Emerging chromatography techniques, such as membrane-based chromatography, may challenge the dominance of HIC in certain applications.

- Shifts in Regulatory Requirements: Evolving regulatory requirements, including a greater emphasis on continuous manufacturing and real-time quality control, could impact purification strategies.

- Technological Breakthroughs: Unexpected breakthroughs in bioprocessing technologies, such as new separation methods or more efficient resins, could disrupt the HIC market landscape.