Investment reports are essential tools for investors and financial professionals to track the performance and evaluate the progress of their investment portfolios. These reports provide comprehensive information about the investments, including financial statements, market analysis, and portfolio allocation. Understanding investment reports is crucial for making informed investment decisions and ensuring the alignment of investment strategies with financial goals. This article will delve into the key aspects of investment reports, highlighting their importance and how to interpret them effectively.

Overview of Investment Reports

Investment reports are detailed documents that comprehensively overview an individual’s or organization’s investment activities and performance. Investment reports like a quarterly investment report can give an overview to capture the performance of investments over a specific period. The reports contain a wealth of information, ranging from financial data to market analysis, allowing investors to assess the strengths and weaknesses of their portfolios.

Components of Investment Reports

Financial Statements

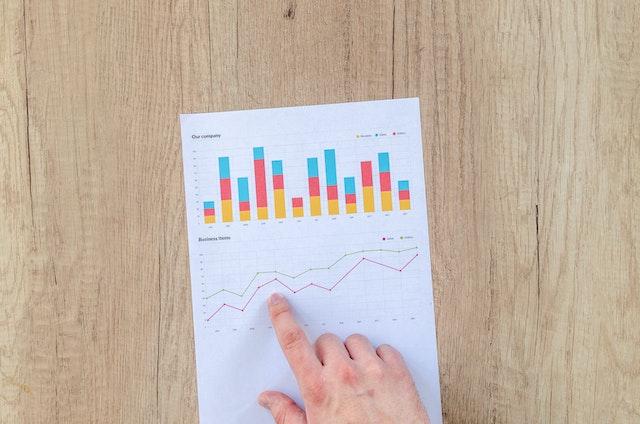

Financial statements are one of the fundamental components of investment reports, including balance sheets, income statements, and cash flow statements. These statements provide a snapshot of the financial health of the investments and offer insights into the profitability, liquidity, and overall performance of the portfolio.

Performance Analysis

Investment reports also incorporate a performance analysis section, which evaluates the performance of the portfolio over the reporting period. This analysis compares the investment returns with relevant benchmarks and assesses the portfolio’s risk-adjusted returns. Performance analysis helps investors identify areas of strength and weakness within their investment strategies.

Portfolio Allocation

Another crucial aspect of investment reports is portfolio allocation. This section outlines the distribution of investments across various asset classes, such as stocks, bonds, real estate, and commodities. It provides a breakdown of the portfolio’s diversification and helps investors assess whether their investments are appropriately allocated to manage risk and maximize potential returns.

Interpreting Investment Reports

Reviewing Performance Metrics

Investors should pay close attention to the performance metrics provided in the investment reports. Metrics such as total returns, annualized returns, and compound annual growth rate (CAGR) indicate the performance of the portfolio over the reporting period. By analyzing these metrics, investors can assess the effectiveness of their investment strategies and make necessary adjustments if needed.

Comparing Against Benchmarks

Benchmark comparison is an important aspect of interpreting investment reports. Benchmarks are market indices or other investment vehicles that serve as reference points to evaluate the performance of investments. By comparing investment returns with relevant benchmarks, investors can determine whether their portfolios are outperforming or underperforming in the market.

Evaluating Risk Management

Investment reports also provide insights into the risk management strategies employed in the portfolio. Investors should evaluate the risk metrics, such as standard deviation, Sharpe ratio, and downside deviation, to assess the level of risk associated with their investments. Understanding risk measures helps investors gauge the potential volatility and downside risks of their portfolios.

Analyzing Asset Allocation

Asset allocation plays a crucial role in portfolio performance. Investors should analyze the asset allocation section of the investment report to ensure diversification and alignment with their investment objectives. An optimal asset allocation strategy balances risk and reward by spreading investments across different asset classes based on their risk-return profiles.

Monitoring Fees and Expenses

Investment reports also disclose the fees and expenses associated with the investments. Investors should carefully review this section to understand the impact of fees on their overall returns. High fees can significantly erode investment gains, so assessing whether the fees charged are reasonable and justifiable for the services provided is essential.

Identifying Opportunities and Risks

Investment reports offer valuable insights into market trends and potential opportunities and risks. By analyzing the market analysis section, investors can identify emerging investment opportunities, industry trends, and potential risks that can impact their portfolios. This information allows investors to make informed decisions and adjust their investment strategies accordingly.

Conclusion

Investment reports are indispensable tools for investors and financial professionals, providing comprehensive information on the performance and composition of investment portfolios. By understanding the components of investment reports and effectively interpreting the data presented, investors can make informed decisions, monitor their investments, and align their strategies with their financial goals. Regularly reviewing investment reports is crucial for evaluating portfolio performance, identifying opportunities, managing risks, and achieving long-term investment success.