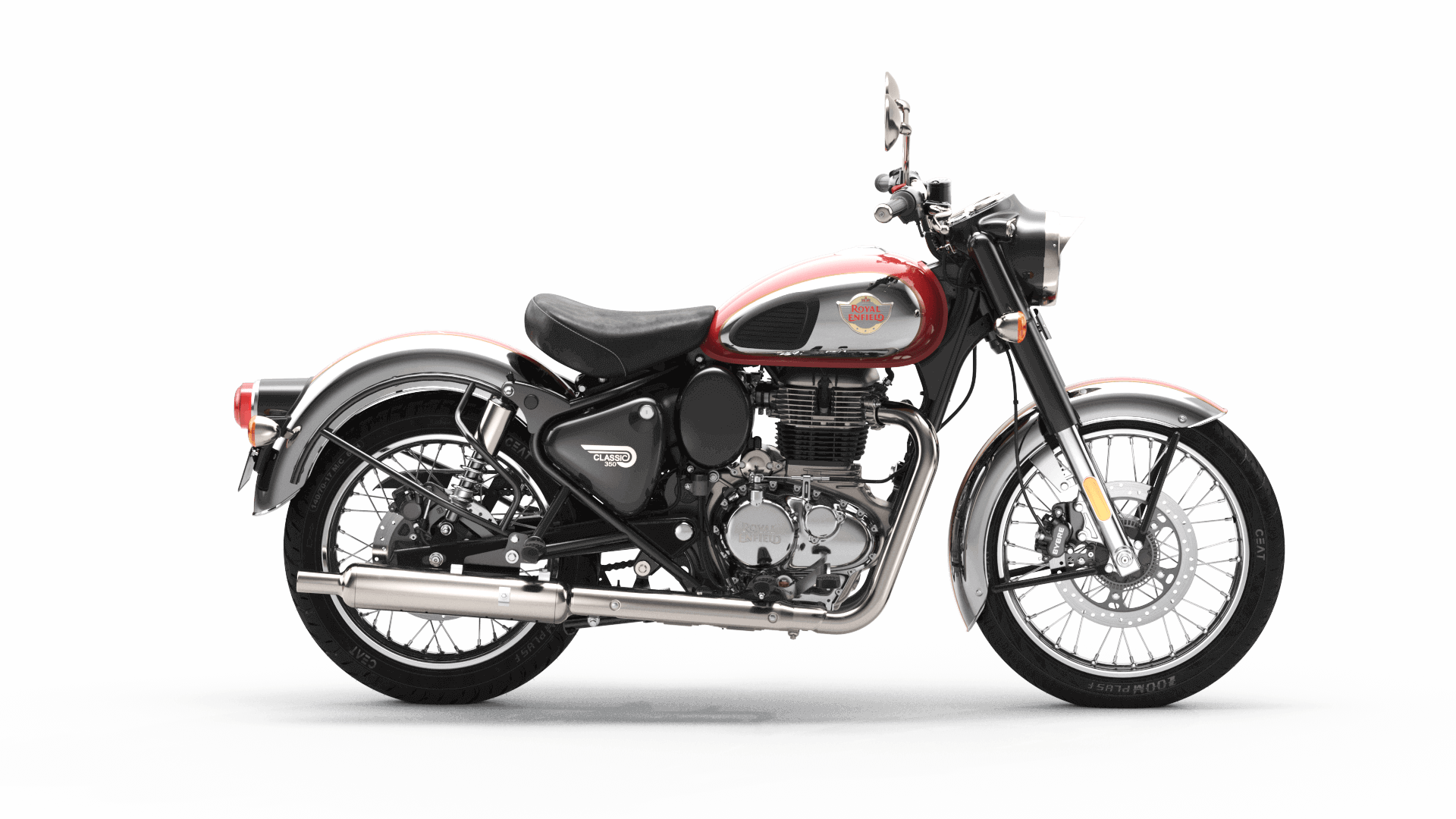

Motorcycles are expensive. They cost what might be a year’s salary for many people, and the price only goes up as you add more customization. And if you don’t have motorcycle insurance, it can increase your financial burden exponentially.

Motorcycle insurance is more than just fulfilling your state’s registration laws. It’s about protecting you, your vehicle, and anyone in the vicinity of an accident. Although it can range from a few hundred dollars to $2,000 depending on the rider and location, motorcycle insurance will often be required by law in most states.

Finding the best motorcycle insurance company isn’t always easy given all of the options available on today’s market (the number of companies has grown by 50% since 2012). There are lots of different types of coverage to consider too; collision, theft protection, medical payments, or even roadside assistance. Bikes prices varies greatly depending on whether you own or rent and which state you live in. To compare bikes price in Nepal is lot more expensive than those in USA.

As such, you’ll want to find the best motorcycle insurance companies for coverage that fits into your budget while also meeting all requirements. Here are 6 of what we believe are currently the top motorcycle insurance providers

Our Top Picks for the Best Motorcycle Insurance Companies

Markel – Best for Discounts

Geico – Best for Accessory Protection

Harley-Davidson – Best for New Riders

Dairyland – Best for daily riders

USAA: Best for military veterans

Allstate – Best for Bundling

Markel – Best for Discounts

What does it take to be a good motorcycle rider?

You need courage, skill, and intelligence. You also need the best insurance coverage possible.

That’s why we think that Markel is such a great option for riders like you—because they offer more than 45 years of experience, and because they provide one of the widest ranges of coverage options available anywhere, including discounts.

Talking about the discounts, Markel offers nine different discounts that range from easy requisites to more difficult ones. For instance, some of them include anti-lock brakes, multiple motorcycles insured with Markel, being a safe driver and having a policy, and renewing your policy. Besides the standard options, there are a variety of additional ones for this company. Some examples of these include allowing people to insure their trailers, as well as mechanical breakdown coverage.

Additionally, Markel’s accident forgiveness program helps you waive any at-fault surcharges for your first at-fault loss. Unfortunately, you have to be accident-free for four consecutive years to be eligible.

Pros and Cons

PROS

- The expansive list of discount

- Coverage variety includes mechanical breakdown coverage

- Offers accident forgiveness program

CONS

- Not available in all states (Massachusetts or North Carolina)

- Rates vary according to state

Coverage

Markel Motorcycle Insurance program provides customizable coverages to protect your bike and all of its accessories. Markel offers the following types of coverage within its policies:

- Collision and Comprehensive

- Accessory coverage up to $30,000

- Uninsured/underinsured motorist property damage

- Mechanical breakdown coverage

- Trailer coverage

- Medical payments coverage

- Uninsured/underinsured motorist bodily injury

- Funeral expense coverage

- Bodily injury liability

- Property damage liability

- Passenger liability

- 24-hour emergency roadside assistance

- Emergency delivery of supplies

- Emergency tire and battery service

- Emergency trip interruption reimbursement

- Customized road mapping service

- Locksmith service

Markel additionally covers numerous motorbike models, making it popular among individuals who are having difficulty obtaining insurance. The business covers every one of the following types of motorcycles and trikes.

- Cruisers

- Touring motorcycles

- Sportbikes

- Sport-touring bikes

- Big twins

- Street bikes

- Scooters/mopeds

- Dirt bikes

- Trikes

- Custom motorcycles

Harley-Davidson – Best for New Riders

Many people love motorcycles and the feeling of freedom they provide. With Harley-Davidson insurance, you can enjoy that feeling without worrying about your bike getting damaged or stolen. That’s because Harley offers a wide range of motorcycle coverage options to suit your needs and budget. Whether you only ride occasionally on weekends or every day for business, their coverage is designed with you in mind.

Further, you must be aware that Harley-Davidson is not just an insurer; it also provides loans, extended service plans, and other perks. The company offers its customers a roof where they can get theft and appearance protection as well. Harley-Davidson is a one-stop-shop for motorcycle insurance and other needs making it an excellent option for new riders.

Discounts include multi-policy discounts for bundling policies, anti-theft, multi-cycle, military and law enforcement, prompt payer, and claim-free renewal. You can also reduce your insurance costs by completing safety courses from the Harley-Davidson Riding Academy.

Pros and Cons

PROS

- Extensive coverage options for all motorcycle brands

- Coverage includes maintenance, roadside assistance, and warranty options

- Offers discounts and benefits for Harley Owners community members

- The outstanding accident forgiveness policy

CONS

- Coverage not available in all states(unavailable in Alaska, Hawaii, or Washington, D.C)

- Slightly expensive compare to other insurance companies.

- No other types of insurance policies (car, homeowner, etc)

Coverage

Regardless of the make or brand of motorcycle you drive, Harley-Davidson Insurance is prepared to provide you with coverage. The coverage options include:

- Liability coverage

- Comprehensive and Collision

- Uninsured/Underinsured Motorist (UM/UIM)

- Medical Payments

- Coverage for helmets and safety apparel

- Total Loss Coverage

- Trip Interruption Coverage

- Roadside Assistance

- Guest passenger liability

- Bodily injury liability

- Property damage liability

- Vacation rental

- Personal injury protection

- Rental reimbursement

- Accident forgiveness

- Additionally, with each of its insurance, Harley-Davidson adds some exciting extras:

- 24/7 roadside assistance for towing, battery replacement, fuel deprivation, flat tires, and lost keys is included.

- Optional equipment coverage for custom or after-market parts

- In the case of a total loss, payouts for bike replacement costs

- Offers rental reimbursement while your bike is in the shop

- Vacation rental coverage if you rent a motorcycle while on vacation

- Offers theft protection in the case of a stolen bike

- Maintenance plan and warranty extension for up to seven years

Dairyland – Best for Daily Riders

Although many firms provide motorcycle insurance these days, few are willing to take on high-risk drivers and one of them is Dairyland. According to statistics collected by the National Highway Traffic Safety Administration in 2013, motorcycles were more frequently involved in fatal collisions with fixed objects than other vehicles. Dairyland Insurance will cover all the high risks drivers with a less-than-stellar driving history.

Besides that, Dairyland offers emergency roadside assistance coverage to keep your bike moving in any situation. With only one phone call, you can get fuel refills on the go. Plus if there’s an issue with your bike that requires mechanical repairs or a tow truck ride back home then Dairyland will cover those expenses too.

If you’re a daily rider, then your motorcycle is the only way to get to work or for events, and when accidents happen you need Dairyland. They offer replacement cost coverage for motorcycles that are less than three years old, unlike many other companies that have a mileage limit or set a one-year cap on full replacement coverage. In addition, they cover the costs of rental vehicles while motorcycles are being repaired. Riders can be sure they’re covered with Dairyland!

Pros and Cons

PROS

- Coverage option to use original manufacturer replacement parts in repairs

- Replacement cost coverage for bikes up to 3 years’ old

- Sells SR22 insurance for high-risk drivers

CONS

- Motorcycle coverage is limited to 45 states.

- No online claims processing

Coverage

For motorcyclists of all types, Dairyland offers a variety of coverage choices. The following are some examples of coverage options:

- Property damage and bodily injury liability coverage

- Collision and comprehensive

- Uninsured motorist coverage

- Medical payment provisions

- Personal injury protection

- 24/7 roadside assistance

- Rental and replacement cost

- Agreed value coverage for specialty or vintage bikes

The business covers all types of motorcycles, from manufacturers such as Harley-Davidson, Honda, and Indian. And a range of models, including:

- Cruisers

- Touring

- Sportbikes

- Dirt bikes

- Moped

- Scooter

USAA: Best for military veterans

Motorcycle riders are always looking for the best motorcycle insurance rates. USAA has some of the best rates on the market. In addition, the business has an excellent reputation with rating agencies such as the Better Business Bureau and J.D. Power, which have consistently given it top ratings.

If you’re a current or former military member, USAA is the place to go for motorcycle insurance. U.S. military members, veterans, and their families can take advantage of special discounts and obtain the lowest rates on one of the best motorcycle insurance plans because they are eligible for extra perks and benefits.

Another advantage of purchasing motorcycle insurance from USAA is that it includes financing and loans for motorcycles. As a result, it acts as a one-stop-shop for individuals who are purchasing a new vehicle. Motorcycle loans and financing are available through USAA up to a maximum of 100%.

Pros and Cons

PROS

- The industry leader in customer service with 24/7 claim filing

- Competitive rates and numerous discounts

CONS

- Available only to current or former military personal

Coverage

USAA offers all of the essential types of coverage for your motorcycle, including:

- Property damage and bodily injury liability

- Collision and comprehensive

- Uninsured motorist coverage

- Medical payment provisions

- 24/7 roadside assistance

- Custom parts coverage up to $30,000

While USAA’s motorcycle insurance is pretty basic, the firm covers almost any sort of bike and trike, including:

- Cruisers

- Touring motorcycles

- Sportbikes

- Street bikes

- Scooters/mopeds

- Dirt bikes

- ATVs

Geico – Best for Accessory Protection

Geico’s comprehensive and collision coverage includes accessories coverage for free. This means your helmet, non-stock sidecar, trike conversion kit, seats and saddlebags, electronic equipment, and chrome components are all protected.

Similarly, customers can adjust their motorcycle insurance to match their specific demands, so no-fault options are not automatically included in policies.

In addition, Geico also offers seven different discounts, including a 10% discount on your premium if you switch from another company, if you protect more than one motorcycle with Geico, and if you become a long-term customer.

Pros and Cons

PROS

- Free emergency roadside service

- Offers 7 discounts options to choose from

- Option to pay in a lump sum or payment plan

CONS

- Fewer add-ons than other companies

- You might not be eligible for some discounts, such as the mature rider’s discount.

Coverage

A motorcycle insurance policy protects you, your bike, and other road users. The following are some of the coverages included in a GEICO Motorcycle Insurance plan:

- Bodily injury liability coverage

- Collision and Comprehensive coverage

- Personal injury protection

- Property damage coverage

- Uninsured/underinsured motorist coverage

- Coverage for emergency roadside service

GEICO’s Motorcycle coverage covers a wide range of motorcycles. Motorcycle insurance can apply to the following vehicles:

- Cruisers

- Sport Bikes

- Touring Bikes

- Custom Motorcycles

- Mopeds

Allstate – Best for Bundling

Allstate Motorcycle Insurance has several excellent motorcycle insurance policies. They have been providing their customers with the best coverage from motorcycle accidents for over 50 years. The company not only covers your bike but will also cover any passengers riding it along with any other vehicle you might be towing. Allstate provides personal injury protection to both you and your passenger in case anything should happen while you’re on the bike.

The policy will cover your bike if it’s damaged by a hit-and-run driver, vandalism, fire, tree limbs, salt corrosion, or an animal attack. Allstate also provides a great roadside assistance program that covers many different services such as flat tires, battery jump starts, accidental lockouts, or tows from

Save up to 30% on your premiums when you bundle your bike insurance with any other Allstate insurance product. This is one of the most generous bundling discounts available, typically limiting at ten or fifteen percent.

They also offer excellent add-ons for your motorcycle insurance, such as lease/loan gap coverage and a first-accident exemption.

Pros and Cons

PROS

- Up to 30% discount for bundling

- Better-than-average coverage options

CONS

- Doesn’t cover vintage motorcycles

- Few discounts

Coverage

Insurance helps protect you in case of an accident and many states require motorcyclists to purchase minimum amounts of insurance coverage to drive legally on the road. Allstate motorcycle insurance plan covers the following aspects.

- Bodily injury liability coverage

- Property damage liability coverage

- Medical payments coverage

- Personal injury protection

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist bodily injury coverage

- Towing and labor coverage

- Rental reimbursement coverage

- Motorcycle and off-road vehicle transport trailer damage coverage

- Lease/loan gap coverage

- Optional or added equipment coverage

Best Motorcycle Insurance FAQ

How much is motorcycle insurance?

The minimum liability and coverage required for a motorcycle differ from state to state. The cost of motorcycle insurance varies based on the type of motorcycle and if it is registered as simply a motorcycle or as a moped, custom-made, classic, street-legal dirt bike.

It also will depend on the age and gender of the driver as well as the amount of coverage selected such as comprehensive or all risks coverage. Finally, your zip code will play a factor in how much you pay for insurance. Depending on where you live, premiums can range from $1000-$3000 annually.

If you are looking for motorcycle insurance, you should make sure to shop around. Insurance companies use different pricing methods and some offer better deals than others. For example, motorcycle insurance from the same company might be more expensive in one city but less expensive in another.

How to get motorcycle insurance?

You will need to get motorcycle insurance before you go out and buy a bike. To do this, you’ll need to check into what your state requires; some states require insurance if you want to use your bike on public roads while others only require the license to be able to legally ride on the road. When you’re looking for insurance, consider what coverage options are important for your needs. You may want medical coverage in case something happens with the bike or liability protection in case of an accident; make sure you get enough coverage according to your needs.

Is motorcycle insurance cheaper than car insurance?

Motorcycle insurance should be cheaper than automobile insurance because cars get into accidents more often. When it comes to the cost of the parts and labor for repairing either one, motorcycles win out by far!

How much motorcycle coverage should I get?

Many different factors will determine how much motorcycle coverage you need. One of the most important factors is the value of your motorcycle. The more expensive it is; the more insurance coverage you will need. Other factors to consider are where you reside, if anyone else will be riding with you, and if you own a condo or not.

The last factor that should be taken into consideration is if you live in a riskier environment. If your motorcycle is stolen from your work parking garage, for example, then it’s important to get enough insurance to cover it for this reason alone!